Best viewed in landscape

This has been something I’ve wanted to detail for a while as I’d like to share my thoughts on serving the MSP channel as a software vendor.

I have found that over the years a few companies I’ve spoken with have had aspirations to go after MSPs as they’ve seen great success from other software vendors in the space, including ones I have had the privilege to work with.

I intend to write a few posts on various topics around my experiences with targeting MSP and I’m hoping you find some of this useful as you contemplate a similar journey or even consider if you need to rethink your MSP strategy.

About me

I’ve been in Product mgmt (PM) for a few years mainly focused on Cybersecurity tech, sprinkled it with Backup Disaster Recovery and a few other software categories via advisory work. I’m drawn towards strategy more than the tech, as PM is a strategic role – despite what people may think

I’m fascinated with customer problems and personas (B2B and B2C) with finding ways to solve these problems and access these customers on a huge scale

I’m currently taking some time off after a few fun years of M&A activity but will be back working with a great team soon!

Caveats

- This is not going to be the most eloquent read, but hoping that it makes enough sense to get the key points across

- I will generalise a lot, firstly as I am not going to give any proprietary information from previous engagements, but mostly due to the fact that when talking about MSPs/RMMs/PSAs…etc, there are so many of them that I’m not going to get hung up on the specifics

- It may come across that this is all my findings, but I’ve worked with great people over the years who have more experience than me that have shared their insights and this is my interpretation

- I’ll do my best to attribute any research and apologise in advance if I miss something – I’ll go back and fix this if flagged

- Lastly, I may get bored of writing up this series midway so don’t be surprised if I do not complete this!

What I intend to cover

Off the top of my head and in no particular order, these are the most relevant topics I’ll cover. Notice that 80% of the topics have little to do with the feature/functionality of products, this is intentional and emphasises a key point you’ll pick up on throughout.

- What is an MSP? – Covered post 1

- TAM/SAM – Covered post 1

- Economics of an MSP and their customers – Covered in post 2

- Personas – Covered in post 2

- Vertical analysis-Covered in post 2

- Share of Wallet – Covered in post 2

- The assisted sale Covered in post 3

- Product Penetration Scale Covered in post 3

- Financial Modelling Covered in post 3

- SaaS metrics Covered in post 3

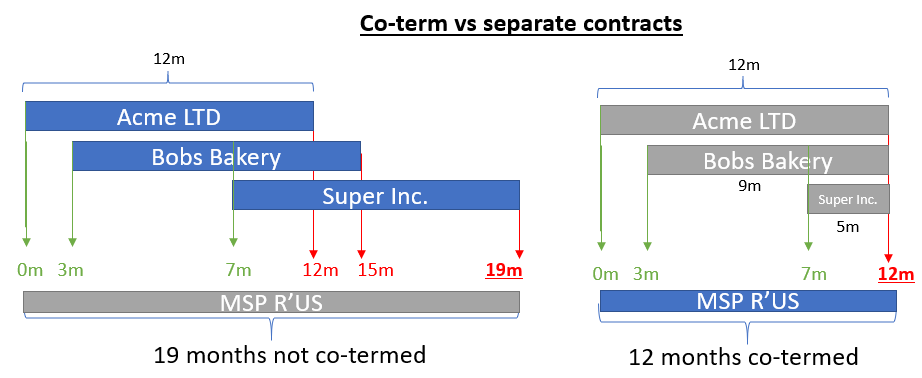

- Commercial agreements/billing – Covered in post 4

- Research, Analysts, consultants and forums – Covered in post 5

- Marketing and Shows – Covered in post 5

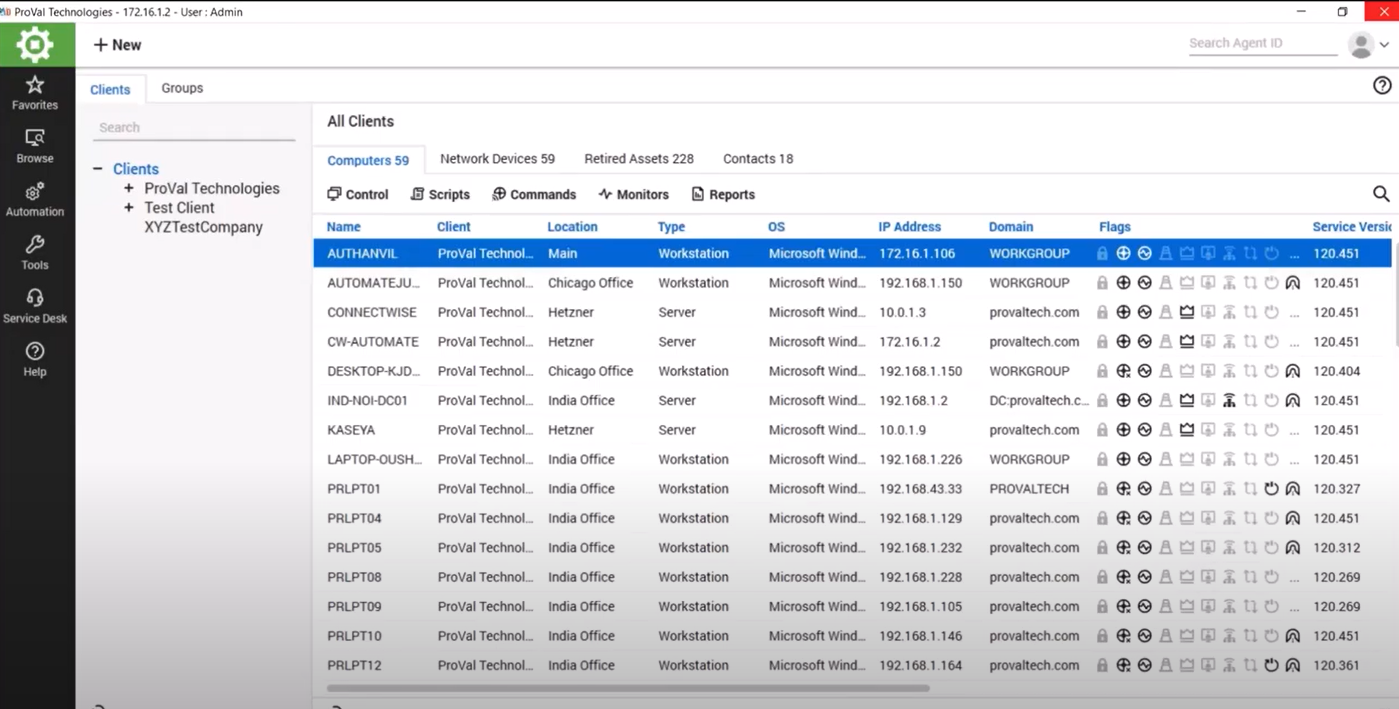

- RMM’s, PSA’s and integrations – Covered in post 6

- Product capabilities and principles – Covered in post 7

- ‘MSP team’ investment requirements – Covered in post 8

I’ll come back and update and refine this as I go along – I am a Product guy so I reserve the right to pivot!

“Let’s target MSPs!”

It’s a phrase I’ve heard many times and one which often stems from observing competitors’ journeys and successes.

The key question is ‘Why do software vendors see the MSP channel as so lucrative?’.

I’ve had the pleasure of working with some world-class finance folks over the years and I remember about 7/8 years ago I was listening to them explain that if we did not acquire any more customers we would still see growth in our MSP channel – I think it was pegged at around 10-15% CAGR

This was puzzling as you’d expect that not acquiring customers would mean a contraction in revenue when factoring in customer churn (non-renewals)… but here lies the interesting thing about MSPs and their business model I am looking forward to sharing with you.

This is one reason, but there is another really important concept with ‘the assisted sale’ and the MSP’s channel reach into SMBs. I’ll touch on this and TAM/SAM/financial modelling in later posts.

Counter to the opportunities with MSP’s there is a dangerous perception of being able to push any product/service into the MSP channel, I’ve spent a good deal of time with executives emphasising the notion of ‘Wallet Share’ which is extremely relevant when working with MSP’s – more on this in the personas/economics of MSP section.

I want to stress that the MSP channel is not easy going – in fact the last 3-5 years have seen many companies try and fail in this channel, wallet share is one reason, and other reasons revolve of course around Product+Vendor/Market fit – this is a multi-faceted issue which I have a few surprises for you when talking about Product principles, team investment, integrations, RMM’s and PSA’s.

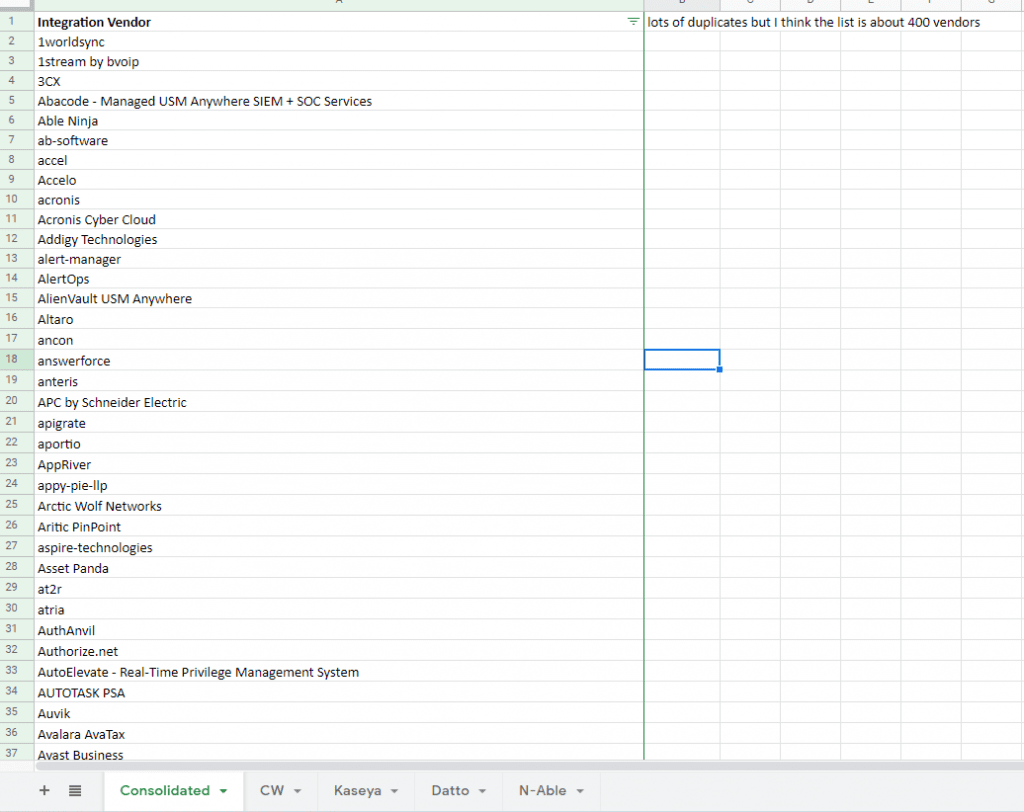

To give you an idea of the players in the MSP space I did a very rough scrape of all vendors in the integration marketplaces across a few RMM’s, this shows about ~400 vendors with active integrations. There are certainly many more vendors out there targeting MSP’s but my take is that if you don’t have an integration with an RMM or PSA, you are not really a player. More on this when we get to integrations.

List: MSP vendors.xlsx

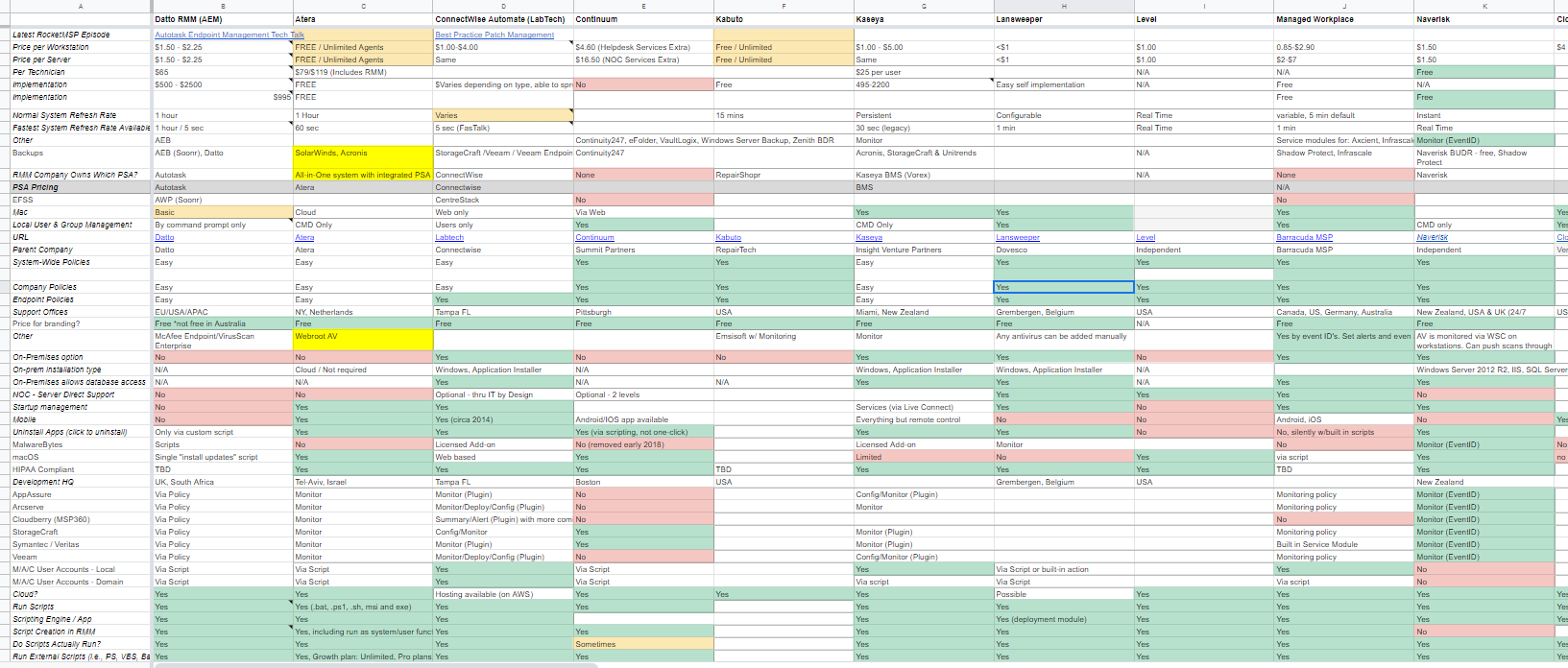

There is also a neat well maintained crowdsourced spreadsheet hosted by RockMSP which double-clicks into the RMM’s and the main features and pricing. I’ll spend a lot of time on Product/Market fit so keep this spreadsheet bookmarked!

List :MSP Comparison Charts

Now onto the first topic…

What is an MSP?

Before diving in too far it’s important to level set on what a Managed Service Provider (MSP) is.

Past colleagues of mine will chuckle when I say this, but the number of times we spoke to ‘world-leading analyst firms’ and they’d constantly misunderstood our requests to understand more about MSPs and start talking exclusively about MSSPs was comical. I’ll go more

into this when discussing research…

For the purpose of this post and series, I’ll borrow Techaisle’s explanation of an MSP:

- The ability to sell services independently from product sales (while maintaining the ability to sell products to customers as well).

- The ability to package and efficiently deliver standardised services to multiple customers, growing by expanding portfolios of discrete services rather than by simply agreeing to address sprawling customer requirements on a ‘one-off’ basis.

- The ability to align internal processes and costs/cash flow with recurring revenue (rather than transactional) approach to the business.

I also like this graphic from MSP360 (ignore typo) to illustrate service specifics, they also have further definitions on their site:

It’s important not to confuse MSP’s with:

- VARs (Value added Resellers)

- SI’s (Systems Integrators

- Consultants

- Service Providers, like an ISP/Telco or platform provider.

- And… MSSP’s! Managed Security Service Providers.

TAM/SAM

When looking at MSP TAM (Total addressable Market) this is where it gets interesting… I found out quickly that MSPs don’t all nicely self-tag themselves and there is no a global industry NAICS code for them, however, my take is that there are currently ~140k MSPs globally which would fall into the definition of an MSP.

This number is derived from multiple sources and has passed the sniff tests of many I’ve spoken to within the investment and analyst/consultant and vendor community. This is important to understand when modelling/forecasting and planning your GTM activities.

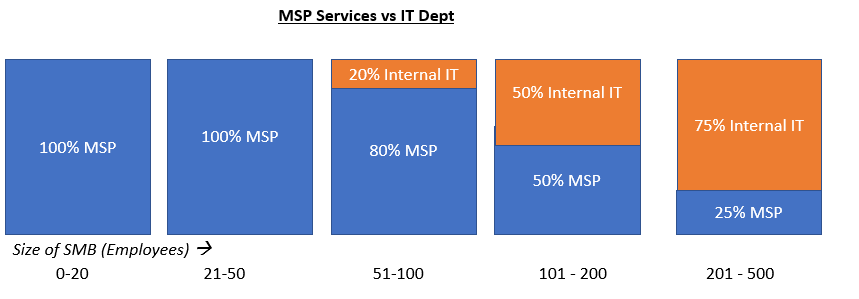

I’ll go into geographic breakdowns and other nuances behind this 140k number here as it’s imperative to understand both the TAM and your SAM (Serviceable Addressable Market). The demographics/firmographics behind this number are equally important as to state the obvious, not all MSP’s are the same shape and size, in fact, the difference can be so stark that if you bet on the wrong type of MSP, you could see a lot of downstream issues.

One thing I’ve managed to extract over the years is some of these differences as well as find a relatively straightforward way for vendors to quickly identify the type of MSP they are dealing with – you’ll see how important this is throughout this series. I won’t go into how this was derived in too much detail, but it involved many months of research and consultant engagements, it’s still refined every so often as the market evolves:

Firmographics:

|

Small MSP |

Medium MSP |

Large MSP |

|---|---|---|---|

|

Annual Recurring Revenue (ARR) |

<$500k |

$500k – $5m |

$5m+ |

|

Number of Endpoints under mgmt |

<500 |

500-4999 |

5000+ |

|

Number of customers |

<30 |

30-99 |

100+ |

|

MSP Employees |

<10 |

10-29 |

30+ |

TAM/SAM:

|

|||

|

% of MSP’s Globally |

70% |

27% |

3% |

|

# MSP’s Globally |

98K |

38K | 4k |

| # MSP’s In English speaking GEO’s (Example SAM = AMER,UK+IR+some EU,ANZ) |

70K | 28K | 3K |

| # Endpoints under Mgmt. in SAM | 17m | 70m | 23M |

A key recommendation is that you always understand the size of MSP as early as possible in the sales cycle, this should influence the way to engage and forecast. One simple way is to ask how many endpoints they managed, I’ve found that any revenue related questions can be a tricky topic during first contact. Also, customers sometimes don’t differentiate recurring revenue from project or product re-sales so it can be misleading.

Looking at the TAM data, you can break this down further in to SAM – I’ve focussed mainly on English speaking geo’s and part of europe, so I have approximate data for this with what I believe 70%-75% of the MSP market is serving SMB here.

Finally, we can have a SWAG at the endpoint or user count, I’ve worked mostly with endpoints based on the services that I’ve worked with. We end up with 110M endpoints served by MSP’s in an English speaking (+ some EU) Geo’s. You are probably wondering how I came up with this, we will touch on the personas of the MSP customers and product+vendor/market fit later in the series, but the average size client of an MSP is ~20 devices.

Now we have this, we can work out your attainable $’s from each bucket of MSP’s, it’ll depend on the software category we want to look at. I have some good data for Cybersecurity and BDR which I’ll share later…