Best viewed in landscape

This is the second post in this series, if you’ve not read the first post I’d recommend you skim it first for context. As a reminder, here is what I’m covering in this series:

- What is an MSP? – Covered in post 1

- TAM/SAM – Covered in post 1

- Economics of an MSP and their customers – Covered in this post

- Persona types – Covered in this post

- Vertical analysis- Covered in this post

- Share of Wallet – Covered in this post

- The assisted sale Covered in post 3

- Product Penetration Scale Covered in post 3

- Financial Modelling Covered in post 3

- SaaS metrics Covered in post 3

- Commercial agreements/billing – Covered in post 4

- Research, Analysts, consultants and forums – Covered in post 5

- Marketing and Shows – Covered in post 5

- RMM’s, PSA’s and integrations – Covered in post 6

- Product capabilities and principles – Covered in post 7

- ‘MSP team’ investment requirements – Covered in post 8

In the last post, we defined what an MSP is, the TAM breakdown and touched on why vendors look towards the MSP channel as a lucrative endeavour. Today I will cover one of my favourite topics looking into the MSP’s business as well as their customers.

I am a strong believer that to be successful in any Product/Service you must intimately know your customer, this proves especially important with assisted sale approaches like the MSP sector.

Economics of the MSP..and their Clients!

Following this post, I hope you’ll leave with the following:

- Understand the dynamics of the MSP business, their constraints and predominant business models

- Understand the limitations and budgets of the SMB

- Understand what products/services are used by the MSP to serve the SMB , inclusive of Share of Wallet (SOW)

As touched on the last post, MSP’s generally have a set of core services, these services are typically 3 main parts to an MSP’s services

1. Network operations centre (NOC) Services, for example

- Remote monitoring and management of network, server, desktop, laptops

- Managed security (AV, Web/Email Filtering, FW, Patch Management)

- Backup and Disaster Recovery (BDR)

- Managed email/anti-spam

- Managed communications – phone, video conf

2. Help Desk/Support

- Phone/remote and onsite support

3. Professional Services

- Consulting/other services inc. vCIO, project work

You’ll see I missed out Security operations centre (SOC) – I said up front that I would generalise and given that SOC’s are not what I consider mainstream in MSP I’m going to omit this.

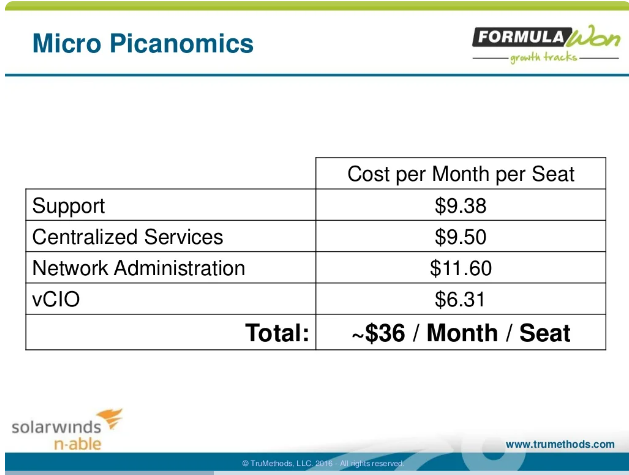

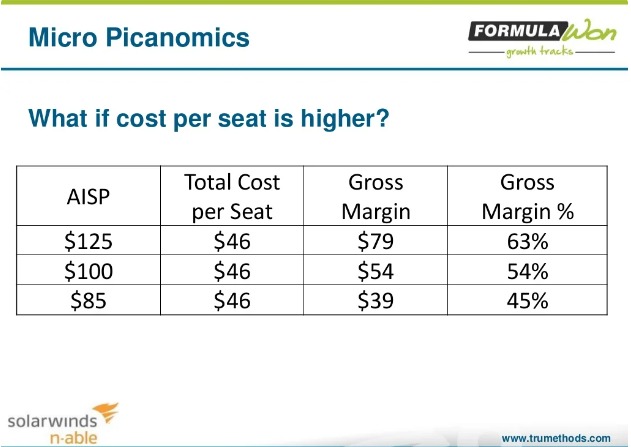

I have gleaned over the years is that MSP’s offer all of the above for anything in the region of $90-$150 per user/per month, this is commonly known as the AISP (All in seat price), with MSP’s targeting a gross margin of ~40 to 60% based on costs. There is a fantastic presentation on this by N-Able and Gary Pica/TruMethods if you want to deep dive on this topic. These slides highlight the key points I’d like to make:

TruMethods/N-Able – MSP costs per seat

TruMethods/N-Able – MSP Margins

Keep these numbers in mind as we progress as it proves important as a vendor when looking at what $’s you can realistically generate with your product/services. It also underpins the Share of Wallet topic.

Diving into the costs, we now can look at the standard software services included, I’m not going to go too deep here, but you can find an MSP calculator freely available on the MSPexchange wiki where you can simulate what your software/service may look like when against all other services MSP’s typically push. Below is another example from a pricing spreadsheet that was shared on Reddit a few years ago although the link is now dead 🙁 (note highlighted):

If you are wondering why I’m detailing all of this it’s because as a vendor of software/services, you need to ensure that the MSP is able to make money from your offering and that there is a ceiling to what they can push to their clients.

Ok, I think we’ve skimmed the key points on how the MSP operates, now let’s look at their customers…

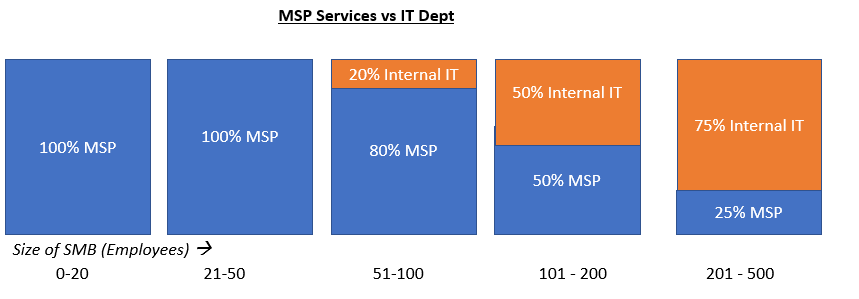

You may have noticed that in my last post I noted that the average size client of the MSP is 20 employees. There is a good reason for this as when you think of businesses that size, they typically don’t have an internal IT department as they leverage the MSP to take care of all things IT. To try and illustrate this, below shows how and when internal IT typically comes in and the MSP ‘augments’ their IT department with their services – diminishing the need for full MSP coverage the larger they get.

This is critical to understand as I remember having the assumption that MSP’s could target the larger businesses and spent time trying to find how to access them. Obviously there are exceptions to this, but this theory holds true with thousands of MSP’s.

If you are trying to access solely large businesses via MSP’s then you will struggle, if as a vendor your service is not suitable for 10 seat businesses you will definitely struggle! More on this when I cover Product Principles in a future post.

Now onto SMB budgets,.. There has been historically good data within Spiceworks State of IT reports, but they’ve not gone into as much detail as before with regards to noting very small businesses. The key point is that MSP’s greatest challenge is trying to squeeze more £$ out of their clients, where the ceiling for managed services is typically the $90-$150 per employee per month, as noted earlier.

Persona Types

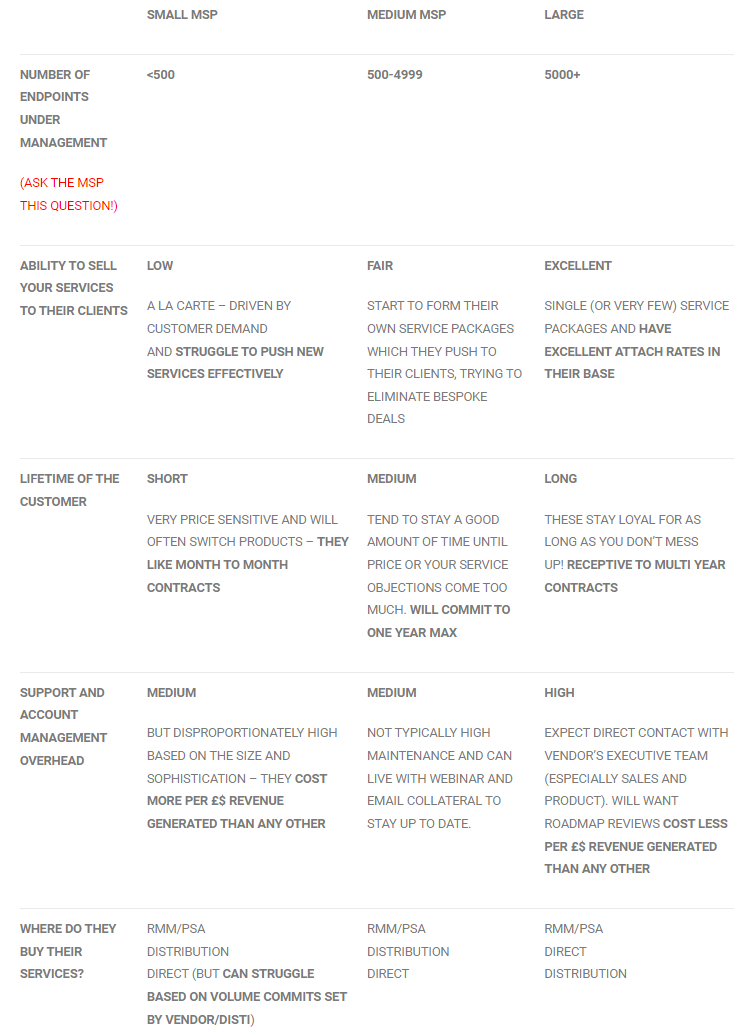

I said in the first post that MSP’s if you target the wrong type of MSP, you could see downstream issues that will become evident here when looking at the 3 main persona’s categories. I’m not going too deep here as this is just a snippet, persona’s should have alot more detail of the pain points and other specific attributes.

There is a very close relationship between the size of the MSP and their sophistication when it comes to their ability to sell your service to their clients. Over the years there have been a few behaviours that have stuck out for me, noted below.

SMALL MSP | MEDIUM MSP | LARGE | |

|---|---|---|---|

NUMBER OF ENDPOINTS UNDER MANAGEMENT (ASK THE MSP THIS QUESTION!) | <500 | 500-4999 | 5000+ |

ABILITY TO SELL YOUR SERVICES TO THEIR CLIENTS | LOW A LA CARTE – DRIVEN BY CUSTOMER DEMAND AND STRUGGLE TO PUSH NEW SERVICES EFFECTIVELY | FAIR START TO FORM THEIR OWN SERVICE PACKAGES WHICH THEY PUSH TO THEIR CLIENTS, TRYING TO ELIMINATE BESPOKE DEALS | EXCELLENT SINGLE (OR VERY FEW) SERVICE PACKAGES AND HAVE EXCELLENT ATTACH RATES IN their base |

LIFETIME OF THE CUSTOMER | SHORT VERY PRICE SENSITIVE AND WILL OFTEN SWITCH PRODUCTS – THEY LIKE MONTH TO MONTH CONTRACTS | MEDIUM TEND TO STAY A GOOD AMOUNT OF TIME UNTIL PRICE OR YOUR SERVICE OBJECTIONS COME TOO MUCH. WILL COMMIT TO ONE YEAR MAX | LONG THESE STAY LOYAL FOR AS LONG AS YOU DON’T MESS UP! RECEPTIVE TO MULTI YEAR CONTRACTS |

SUPPORT AND ACCOUNT MANAGEMENT OVERHEAD | MEDIUM BUT DISPROPORTIONATELY HIGH BASED ON THE SIZE AND SOPHISTICATION – THEY COST MORE PER £$ REVENUE GENERATED THAN ANY OTHER | MEDIUM NOT TYPICALLY HIGH MAINTENANCE AND CAN LIVE WITH WEBINAR AND EMAIL COLLATERAL TO STAY UP TO DATE. | HIGH EXPECT DIRECT CONTACT WITH VENDOR’S EXECUTIVE TEAM (ESPECIALLY SALES AND PRODUCT). WILL WANT ROADMAP REVIEWS COST LESS PER £$ REVENUE GENERATED THAN ANY OTHER |

WHERE DO THEY BUY THEIR SERVICES? | RMM/PSA | RMM/PSA | RMM/PSA |

Above is highly generalised as there are many very sophisticated smaller MSP’s out there, but I would always recommend that if you have a service that requires a decent amount of hand holding from a product or sales perspective, you should focus your efforts at the bigger MSP’s, smaller MSP’s will eat your margins fast!

I recommend you have your own persona’s for the MSP’s, but also their clients. Census data gives you a great idea of SMB’s and the spread of verticals as well as the reports I mention in the next topic. Speak to a lot of MSP’s and SMB’s of all sizes to form your own views as it relates to the problems they have and where your service may be able to help, the best way to do this is at MSP events as well as doing “ride-alongs” with friendly local MSP’s.

One thing I always added to personas was a typical tech spec of their setup as well as their clients, this helped massively when looking at integrations and support requirements.

Vertical Analysis

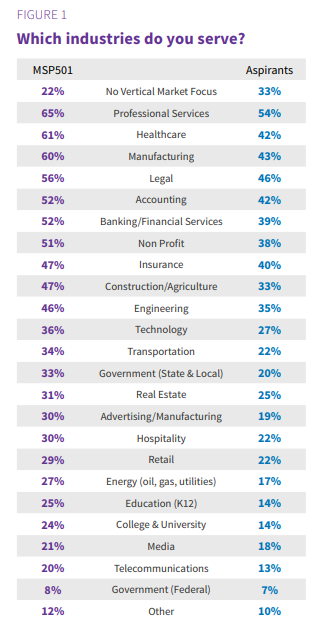

On the topic of verticals, you will see a good blend of MSP’s that focus on verticals vs. those that don’t. I can’t say I’ve seen a direct correlation with size of MSP and vertical focus, but anecdotally, I would say that the many vertical focus MSP’s tend to be in the ‘Medium Sized’ bucket.

Here is a snippet from MSP Mentor asking MSP’s what verticals they serve and whether they solely focus on a specific vertical :

From what I’ve seen as a vendor, I’ll give you a few bullets on veritcals wthin MSP’s:

- If you are dealing with an MSP targeting Finance, Government or Health care you’d better brush up on their compliance requirements and where services like yours are likely to fit in – side note, no one enjoys compliance but if you can help tick the box for the MSP and their clients, they will love you for it!

- You will likely be asked for different pricing models to help with non-for profit and education clients of the MSP. I don’t recommend building a complex pricing model as this will only become a major PITA as you scale up. Just stick with ‘MSP Pricing’ with price tiering on volume

- If you have a per device model, avoid MSP’s focussing on retail/hospitality and even construction – the economics don’t typically work out as they heavily share devices and they have very small margins (especially the restaurant trade).

Share of wallet

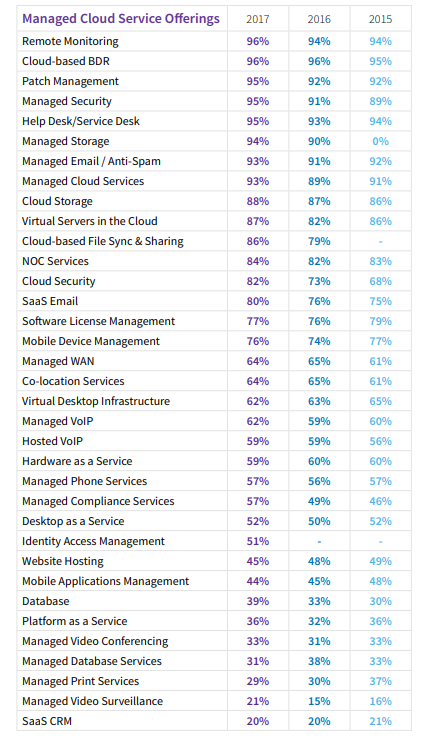

I’ve found the MSP501 data from Channel Futures/MSPMentor very insightful, although they are not as verbose with the data as prior years. As a vendor, the most interesting metrics were in the services used by the ‘top 501’ MSP’s identified by MSPMentor. For example this 2018 copy details the key services offered:

MSP Mentor 2018 – Managed Cloud Service Offerings

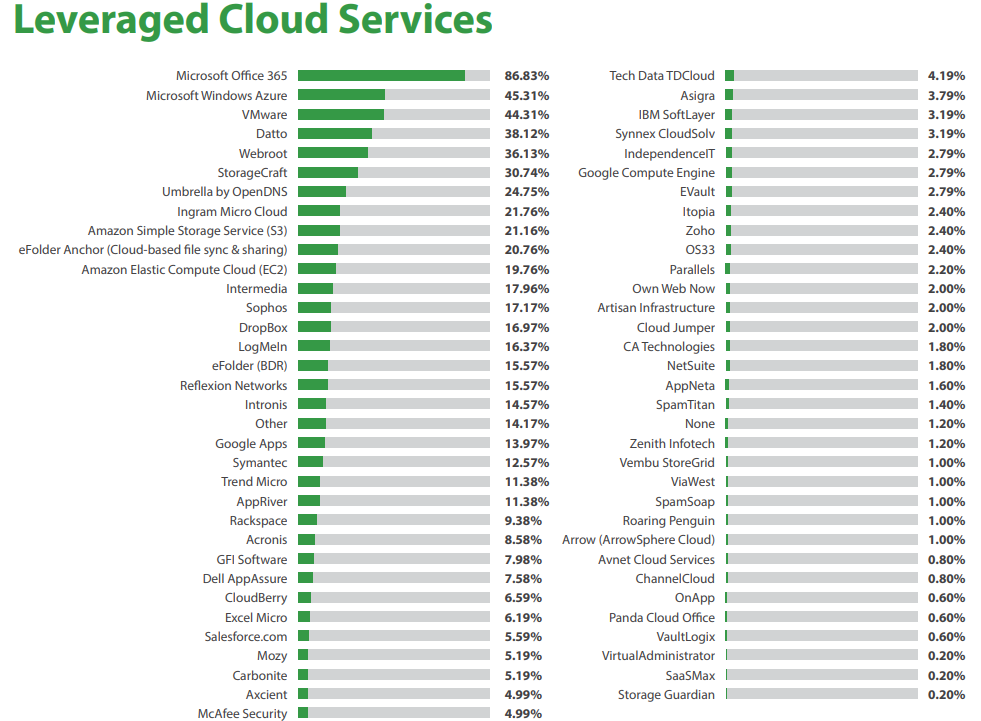

Going back a bit further, MSPMentor published vendor information, this data gave me 1) a good idea of market penetration of our service against competitors 2) ideas of emerging vendors/technologies for new product efforts or M&A. Take this with a grain of salt as their data is based on the largest MSP’s they have relationships with.

MSPMentor 2016 – Managed Cloud Service Offerings

I should note that Kaseya has a good annual report called the “MSP Benchmark”, like MSPMentor, some of the data verbosity has been lost in recent years.

If you are aware of other good sources of information please share!

How does this relate to Share of Wallet? It should now become evident that there are a standard set of services which MSP’s leverage for their clients, as a vendor, it is very challenging to introduce a new type of service into the MSP market if it’s not replacing another existing service.

The sophistication of the MSP plays a big part here as the small MSP’s will typically struggle to squeeze additional £$ out of their customers when presenting anything that isn’t considered mainstream (>70% penetration), however, you may have more joy with the larger MSP’s due to the effectiveness of their sales teams and how they package services.

The beauty of targeting the larger MSP’s with a new type of service is that you will start to see the downward pressure on the medium/smaller MSP’s to follow and offer similar services as the MSP market is extremely competitive!